(My thanks to SKWAWKBOX for this post that appeared yesterday - 21 October 2021)

A proper government response to massive wealth accumulation could easily fill social care funding gap, increase pay for public sector workers by 15% to reduce Universal Credit reliance, reverse the £20 a week cut to UC, solve the housing crisis, reverse education funding cuts – and more. One Labour MP is making the arguments the party’s leader refuses to even raise

A landmark new report by Labour MP Jon Trickett has examined the way that wealth works – and is abused – in the UK and concludes that the case for a wealth tax is overwhelming.

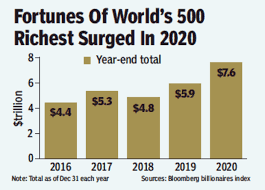

‘The Nature of Wealth in Britain: How Wealth Wields Power and the Case for a Wealth Tax’ notes the enormous increase in the wealth of the richest in this country during the course of the pandemic so far, as millions of others have struggled and fallen into poverty – and that the number of billionaires in Britain is at an all-time high as wealth becomes ever more concentrated in the hands of a few.

And that increase in wealth for a tiny minority is to the detriment of the country as a whole. Trickett points out that the syphoning of

wealth into private bank accounts, often offshore, sucks ‘untapped funds’ away from investment drives that could easily,grow the economy by £220bn per year…

In Britain we don’t tax wealth. We tax earned income. Even with corporation tax we have reduced the tax load so that now it is only raising a quarter of the amount we raise from income tax. The accumulation of wealth is largely ignored. It’s time for this to change. In our late capitalist economy, the idea of touching capital itself is almost a sacrilegious thought.

It’s time we thought the unthinkable.

That is why I have published this report that proposes a radical overhaul of our tax system.

|

| The case for a wealth tax at a glance |

In total, approximately £490.9 billion could be raised in 5 years from the proposals within this report. That is £98.18 billion a year which could be used to build a dynamic green economy focussed on growth and investment rather than simply to tax and spend.

Instead, the Tories are looking to cut public spending and entrench inequality even further. The report’s executive summary explains:

As we approach the Autumn Statement, it looks likely that there will be more cuts to public services. In preparation for the Statement, the Chancellor has asked departments to find “at least 5 percent of savings and efficiencies from their day-to-day budgets”.

We have already seen the government raise national insurance -which they promised not to do in their election manifesto. However, this measure, along with real wage cuts, rising inflation and the crisis over energy prices is only going to hit those on lower and middle income earners. Pushing the burden of tax, and the cost of living, onto those on low and middle incomes is not only unjust it is also unnecessary.

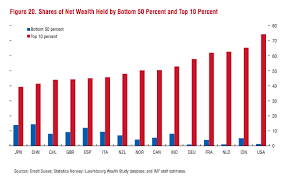

This report shows that there is untapped wealth in this country which at present is lying unproductive. There has been a steady increase in inequality between the very wealthy and everyone else. The richest people have seen their wealth increase, by £538 billion between the financial crash and just before the start of covid. Even under covid, the richest 250 increased their wealth by another £106.7 billion.

The government has been focusing too much on taxing income – i.e the incomes of working and middle class people – yet they have largely ignored the accumulation of wealth. Remember, wealth is taxed at a much lower rate than income.

|

| A reminder of the travesty that has unfolded during this pandemic |

The report proposes four options for a wealth tax to be consulted on. We do not believe in top-down policy making so we have given options for a one off tax, annual tax and a hybrid tax targeting increases in wealth. It also proposes bringing dividends and capital gains in line with income tax. As well as closing the loopholes used to avoid or evade tax and tackling big companies hoarding cash in reserves.

The median revenue which could be raised by the four wealth tax options is£218.4 billion over 5 years. £37 billion over 5 years for bringing dividends into line with income tax and £90 billion over 5 years for levelling up Capital Gains Tax. This would total £345.4 billion in 5 years. This estimate is deliberately conservative to account for behavioural changes, admin costs, and other factors.

Closing tax avoidance loopholes will raise £7.6 billion a year and tackling tax evasion would raise £21.5 billion a year. A total of £29.1 billion a year, £145.5 billion in 5 years.

In total, approximately £490.9 billion could be raised in 5 years, that is £98.18 billion a year which could be used to build a dynamic green economy focussed on growth and investment rather than simply tax and spend.

The money could also be used to fund policies which would increase the spending power of working people, which is key to rebuilding the economy:

– 15% NHS pay increase (£5.1bn nominal cost)

– Making the £20 UC uplift permanent (£6bn)

– Plug the Social Care funding gap (£4.3bn)

– Local Council funding gap (£7.4bn)

– Reverse education funding cuts (£7 billion)

– Insulating all homes, reducing energy bills and cutting carbon emissions by 10%through

– “Warm Homes for All” (£250 billion)

– Building 150,000 houses a year (£75 billion)

|

| The real world of wealth inequality |

This money could also fund big parts of our public services, including:

– The entire yearly education budget of

– £96.1 billion (including schools, colleges, etc);

– The entire Departmental Expenditure Limits of: Local Government, including housing; Transport, the Home Office and the DWPIn order to implement such radical policies, we have to tackle the power wealth wields over our political systems.

Unfortunately, wealth buys influence. In order to make taxing wealth workable, vested interests need to be taken out of our political structures and institutions.

Lastly, we do not want to tax people’s homes, pensions, savings or earnings.

Indeed, the aim of this report is to show that it is the wealthy who should be contributing more, not workers. The latter are already taxed at a much higher rate, and we expect to only tax the wealth of a small number of people in the top 1%.

Trickett’s willingness – unlike Keir Starmer or anyone on his front bench – to make the very winnable argument has attracted high-profile endorsements from the likes of former Labour leader Jeremy Corbyn (no stranger to winning the argument and bringing the public to his view), Ian Lavery, John McDonnell and more.

The report makes four recommendations, four ways in which its principles could be applied: a one-off wealth tax as proposed by the Wealth Commission; a similar tax but graduated on wealth above £2m; an annual wealth tax on a similar threshold; and a ‘hybrid wealth tax consisting of a one-off tax on accumulated wealth and then an annual tax on increases to that wealth.

The Wealth Commission gives an idea of the benefits achievable if the political will is there:

A well-designed one-off wealth tax would raise a total of £260 billion at a rate of 5% over £500,000 per individual or £80 billion at a rate of 5% over £2 million per individual, payable at 1% per year over five years. These estimates account for all relevant behavioural responses and administrative costs to government.

And Trickett adds four further recommendations:

- bring tax on dividends into line with income tax

- bringing capital gains tax into line with income tax

- closing tax loopholes

- a ‘use it or lose it’ policy to force companies sitting on huge cash reserves to put them to work